Documents/Tax Forms

Combined Energy Services is committed to making your experience as convenient and hassle-free as possible. Below you will find links to all of our documents and tax forms. Just click on a link to download and print the form. This page is designed to give you quick access to all of our Tax Forms. If you have any questions please contact us.

CES Forms

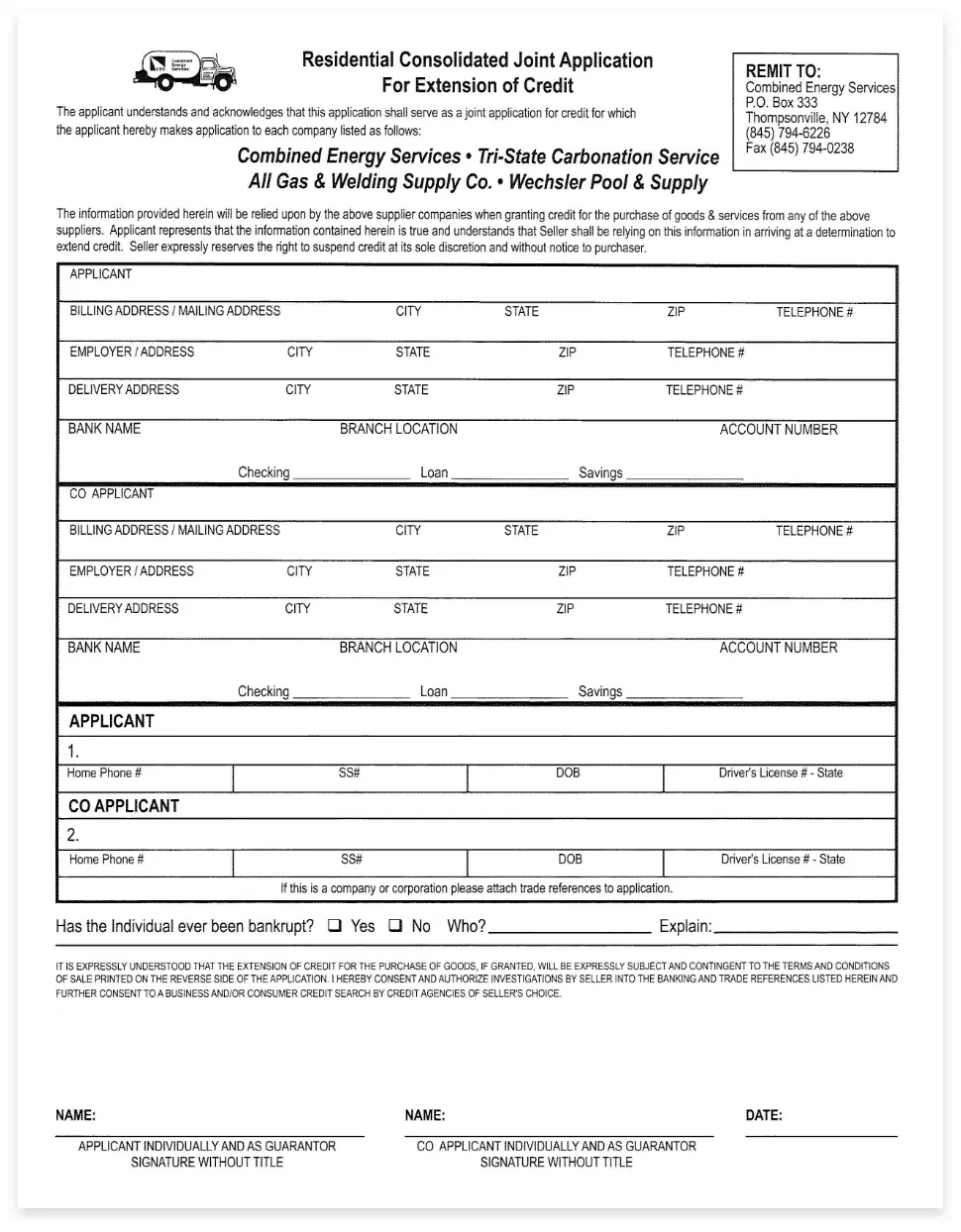

Credit Application

Payment – ACH

- Payment Option – ACH (Subject to Credit Approval)

Payment – Credit Card Expired

- Update expired credit card – Call, mail or fax form

Corporate Personal Guarantee

Service Contracts

- As of August 2023 – service contracts for both propane & oil are being revised.

Third Party Notification

New York Tax Forms

Form ST-120

Form ST-124

Form TP-385

Form AU-630

Form 8849

Form FT-500

Form FT-946/1046

Form AU-11

Form-FT-1021-A

Form 9

Pennsylvania Tax Forms

Form DMF-75

Form DMF-80

Form REV-1220

Form 4

New Jersey Tax Forms

Form 1

Form ST-8

Form ST-3

Form A-3730

Alternative Fuel Tax Credit Forms (Propane)

Instructions

Form 637

- To Register with IRS as an “Alternative Fueler:” Form – 637 – NYS Application For Registration (For Certain Excise Tax Activities)

Form 4136

- To File at end of the year to claim tax credit:

Form 8849

- To make one-time claim for credits and payment allowable:

Form 4

Account Information

Customers have the right to know that the firm delivering propane or providing propane service is qualified. All installations are completed in accordance with NFPA54 and NFPA58 and all state and local codes. By signing the front of our New Customer Information Form you agree you have reviewed all the information on it and that it is accurate. You also agree to the Terms of Service and Company Policies as well as all updates posted on this website. Posted fees are accurate as of February 2022. CES reserves the right to change its fees, rates, and charges from time to time without prior notice to the customer.

Terms of Service

Customers have the right to know about any special conditions of service that would be applied to their account by their supplier. Combined Energy Services (CES) will provide service subject to the following conditions:

- Credit application is required.

- CES reserves the right to require payment at time of delivery (cash on delivery – COD) for customers who are not credit approved. COD customers are able to submit payment via: Cash, Certified Check, Personal Check, Debit Card or Credit Card.

- Payments (other than COD or Advanced Payment Deliveries) are required within 10 days, if credit approved, of delivery. Late payments are subject to a late fee of 1.5% monthly or 18% per annum.

- The following are CES acceptable delivery methods: Automatic Delivery – Deliveries are made on a period schedule or a degree day based system. Automatic Delivery is a free service offered to all customers. The service is merely intended to assist customers from running out of fuel. There are many variables, such as increased fuel consumption, issues in unattended homes and inclement weather, which make such guarantees impossible. Customer Requested Delivery – (will call deliveries) The customer calls for deliveries. CES must be notified 5-7 working days before the desired delivery date. If you run out before we are in your area there are delivery fees that will apply. Fees are as follows (Always COD):

| Mon – Fri | 7:00 am – 3:00 pm | $200.00 |

| Mon – Fri | 3:00 pm – 7:00 am | $250.00 |

| Weekends & Holidays | All | $250.00 |

- There is a minimum delivery for fuel oil of 150 gallons and a minimum delivery for propane of 100 gallons. Any tanks under 100 gallons need to be filled. Requests for a short delivery (or non-fill) are subject to a $95 delivery charge. Tanks must also be at 30% or less to avoid an inefficient delivery fee ($95).This does not apply to our automatic delivery customers. We encourage all customers to go on automatic/keep full deliveries and to use our convenient 12-month BUDGET PAYMENT PLAN which will spread your bills out evenly. If a customer runs out of gas the system must be pressure tested (leak checked) prior to resuming service. This action is classified as a billable service call and will be charged our prevailing hourly rate during normal business hours and an overtime rate after normal business hours. If the driver does the pressure test, a fee of $53.00 plus tax may be incurred. If a service tech needs to come out after the delivery driver was there (whether the customer wasn’t there or an additional issue), then the customer will be billed at the service rate of $163 plus tax for a minimum of 1 hour during regular business hours plus parts if needed. If the service is after hours, the the charge will be the overtime rate of $293.00 plus tax for a minimum of 1 hour plus parts if needed. New Jersey rate are $169.00 regular and $302.00 overtime.

- In order to service your account and/or collect any amounts owed, you agree that CES may call any telephone number associated with your account, including mobile telephone numbers, which could result in additional mobile charges. It is understood and agreed that we may also contact by sending text messages, emails or other forms of electronic means using any email address or contact information associated with the account. Additional methods of contact may include, but not limited to, pre-recorded/artificial voice messages and/or the use of automated dialing devices.

- Due to postage fee increases, there will be an invoice/statement fee of $2.00 applied to all outgoing mail. To avoid this fee please contact us with a valid email address.

Payment Plan & Options

Payment Options: Customers have the right to a price quote in a format that allows for comparison shopping. CES charges for propane based on a per gallon basis. Metered service will be read in cubic feet and converted into gallons for comparison purposes. The price of propane, like any commodity, changes over time. This will affect the bill as the price fluctuates. CES pricing policies will determine how often the bill is adjusted to account for changes in cost of propane. For your convenience, we offer the following pricing options:

- Market Budget Plan: Payments for the year are divided into a fixed monthly payment based on projected usage over a number of months. The payment is adjusted as needed. The market price will fluctuate based on changes in the market.

- Capped Budget Plan: We take the customers projected usage and charge a cap fee per gallon. The cap fee is worked into monthly budget payments to secure the fuel and have a “ceiling price” (price will not rise above that amount). If the market price decreases, you receive the lower price but will not pay more than the secured capped price. The cap fee is non-refundable.

- Fixed Budget Plan: This plan is based on your projected usage and the customer is quoted at a fixed price. The customer is then locked into this fixed (locked) price. Regardless of market price during the Fixed Budget Plan, the price will remain fixed for the term of the budget. The quote is based off usage from October 1 to April 30th. There are no additional fees for this contract.

- Capped Price PreBuy: Customers cap the amount of gallons they would like to use in for the heating season in advance to secure a “ceiling price.” The cap fee must be paid in advance for the number of gallons being capped. There is a minimum 500 gallons associated with this pricing option. The cap fee is non-refundable.

- Fixed Price PreBuy: Customer is able purchase a desirable amount of gallons for the heating season in advance at a fixed price. There is a minimum of 500 gallons associated with this pricing option. Other restrictions may apply.

- The prebuy and gallons are only good from October 1 through April 30. The 500 gallons must be for this period, not for a full year. Any delivery before or after the prebuy is billed at the current regular rate.

There is also state provided energy assistance programs. Please click on your state to be redirected to their website.

Equipment Fees

Customers have the right to rent equipment from Combined Energy Services or use their own equipment. The following are equipment related fees customers should expect :

- Tank Installation Fee associated with a new service.

- Replacement Tank Fee associated with an existing service.

- Rental Fee for tanks and regulators when using CES’ equipment.

- Inspection Fee for tanks and regulators when customer owned equipment is used. The fee is applied prior to initial delivery and annually thereafter.

- Service Fee for work performed on customer’s equipment.

- Pressure Testing Fee (leak checking) testing the customer’s system under the following conditions:

- Prior to establishment of service.

- Interuption of service of any kind, i.e. tanks run-outs, connecting temporary tanks.

- Annual Minimum: All company owned tanks require a minimum amount of gas to be purchased per year based on tank capacity as per agreement (contact the office for your minimum usage requirement.) Customers are required to use 150% of a tank’s capacity per year in order to avoid fee.

- Annual Tank/Equipment Rental & Maintenance Fee – 200 lb tanks (47gal). This fee is $239.00 a year. If you buy your home heating oil from CES and are on auto delivery, the fee lower to $39.00 a year. This fee will be paid up front before a tank is set and a delivery is made. This is to help offset the cost and maintenance of the tank.

- Weigh for Credit Fee: Occurs when customer terminates their services and wishes to receive credit for gas in tank. CES weighs the tank for credit.

Service Fees

Fees for service work as based on the specifics of the particular job being performed. Therefore, all prices are estimated and determined on a case by case basis. When estimates cannot be provided, all work will be furnished on a time and material basis at our current prevailing rate. Contact the office to get the minimum hourly rate.

Other Charges That May Occur:

- Bleed Furnace and Start-up fees

- Collection Fee

- Finance Charges and Late Fees

- Fuel Surcharges (per delivery/service)

- Labor Fees for Service Work (during working hours, after hours & holiday rates vary)

- Light Pilot Fee

Discontinuance of Propane Service

Customers have the right to change suppliers if they are dissatisfied with the price or services offered. The following conditions apply to a discontinuance of service:

- CES will remove their container within 30 days of written notification to discontinue service from the customer.

- CES will notify the customer of the removal date which is approximately 2 days prior to removal.

- CES will charge for the removal of the container and for any restocking charges that may apply should the tank need to be evacuated of remaining propane.

- CES will credit the customer for any gas remaining in the tank within seven days from the time of the equipment removal. A Weigh for Credit Fee will be incurred.

- NJ Customers: At one or two family residential properties the new marketers may disconnect and move containers owned by others: however, the new marketer may not fill a container owned by another marketer. At other properties, the new marketers cannot remove, connect, disconnect, fill, or refill any propane container without written permission from the owner of the container.

Disconnection of Service – Non Payment: Customers have the right to be notified seven days prior to the disconnection of service for nonpayment.

Energy Assistance Programs: The following agency has programs available to assist low-income households with their energy bills. For more information, please contact directly: Low-income Home Energy Assistance Program (LIHEAP) or call 1 (800) 510-3102.

Common Terms

The following are terms commonly used when discussing your propane or home heating oil account.

Cap Price & Fee – Pre-Buy

Maximum price CES will charge per gallon of product when the customer pre-buy’s the fuel requirements.

- Fluctuates depending upon date of contract signing and availability.

The fee is insurance (“Put-Option”) that is paid to the New York Mercantile Exchange (NYMEX) to secure customers quoted fuel cap price and insure customer will never pay more than the Cap Price they were quoted.

- The Cap Fee for Liquid Propane Gas (LPG) is $.12 gallon and Fuel Oil is $.25/gallon (as of 08-05-20 subject to change)

- The Cap Fee is Non-Refundable

Degree Days

Measurement of how hot or cold it has been over a 24 hour period (average daily temperature) in comparison to an average temperature of 65 degrees Fahrenheit.

- EXAMPLE: Outside temperatures range from a low of 53 degree F to a high of 74 degree F. for an average temperature of 64 degree F. which differs from the average of 1 degree. In other words: 1 Degree Day.

- EXAMPLE: Overnight low of 28 degree F. and a daytime high of 43 degree F. for an average of 36 degree F. which differs from 65 degree by 29 degree = 29 Degree Day.

- Degree Days are cumulative: From September 1st to May 21st (National Weather Service)

Enrollment Fee

A fee that is charged to handle processing, upkeep and maintenance of pre-buy accounts when using a credit card as payment method.

4% of Pre-Buy subtotal = (Price per gallon x Quantity Purchased + Price Cap Fee x Quantity Purchased)

E-Z Chair Plan – Budget

Budget plan allows the customer to evenly spread out the payments of annual usage over an twelve month period plus a one-time cap fee.

- Budget plans are adjusted according to the customers fuel usage and current market prices.

- PLAN A: Capped Price (See Cap Price); Steady to decreasing customer cost

- PLAN B: Market Price (See Market Price); Dynamic Consumer Cost (Increases and/or Decreases may be observed).

- Contact any one of our offices and speak to one of our representatives to receive the current Cap Price.

Fuel

Material used to produce heat or power by burning. Any various compressed vapor or volatile combustible liquids that are used to heat water, structural temperature regulation or in the cooking of food or other various uses.

- Includes Propane (LP), Fuel Oil, Kerosene, Biodiesel

K-Factor

Number that shows how fast a customer uses fuel

- Degree Days / Gallons of Product = K-Factor

LP

Liquified Petroleum or Propane

Market Price

Current per diem price that customers are charged per gallon depending upon usage.

- Contact any of our office to speak with a representative to receive the current market price.

Minimum Gallon Purchase

There is a 500 gallon minimum purchase in order to participate in the Pre-Buy (Capped Price Pre-Buy) and to receive any price protection.

Non-fill Fee

Fee that is charged on deliveries where a less than maximum delivery is made (i.e. filling the tank).That fee is currently $95.

Overage

Any gallons of fuel (LP or Fuel Oil) that is used above the customers allotted pre-buy amount for a given contract period.

- At the point which the customer uses more gallons of fuel than pre-purchased, the customer will be charged the most current Market Price for all quantities of fuel.

Pre-buy Plans

The following are the pre-buy plans that are available:

Capped Price PreBuy: Customers cap the amount of gallons they would like to use in for the heating season in advance to secure a “ceiling price.” The cap fee must be paid in advance for the number of gallons being capped. There is a minimum 500 gallons associated with this pricing option. The cap fee is non-refundable.

- Fixed Price PreBuy: Customer is able purchase a desirable amount of gallons for the heating season in advance at a fixed price. There is a minimum of 500 gallons associated with this pricing option. Other restrictions may apply.

- Pre-Buy is available from 10/1 through 4/30. Gallons can be purchased up until 9/30 or until we have sold all of the gallons we have purchased. Whichever comes first.

Pressure Test & Fee

A required diagnostic test performed by our technicians on every new LP (propane) installation or existing gas supply piping.

- The test assesses the integrity of the piping system to assure no leaks and maximize safety.

- Technicians supply the gas line with pressurized air and measure the drop in pressure over a set time.

The pressure test fee is $53 plus applicable county sales tax rate is done by the driver when the delivery is made. If a service tech is dispatched, rate is $163 plus tax for a min. 1 hour during regular business hours plus parts if needed. If the service is after hours, the the charge will be the overtime rate of $293.00 plus tax for a minimum of 1 hour plus parts if needed. New Jersey rate are $169.00 regular and $302.00 overtime.

Regulator

A device that is used to control the flow of gas and lower the pressure of the tank to the appliance(s) in the gas system.

- The regulator not only acts as a control regarding the flow and distribution of propane but also as a safety barrier between the high pressure of the tank and the end use appliance(s).

If You Smell Gas

- Exit the building, without using the telephone or cell phone, operating any electrical switches, lighting any

matches or smoking materials. - If possible, turn off the gas at the container or meter valve.

- Call 911 from a neighbor’s home.

- DO NOT re-enter the building until emergency responder tell you it is safe to do so. Your marketer is required

to respond in case of an emergency.

**All Tracpipe installations require bonding by the customer’s electrician

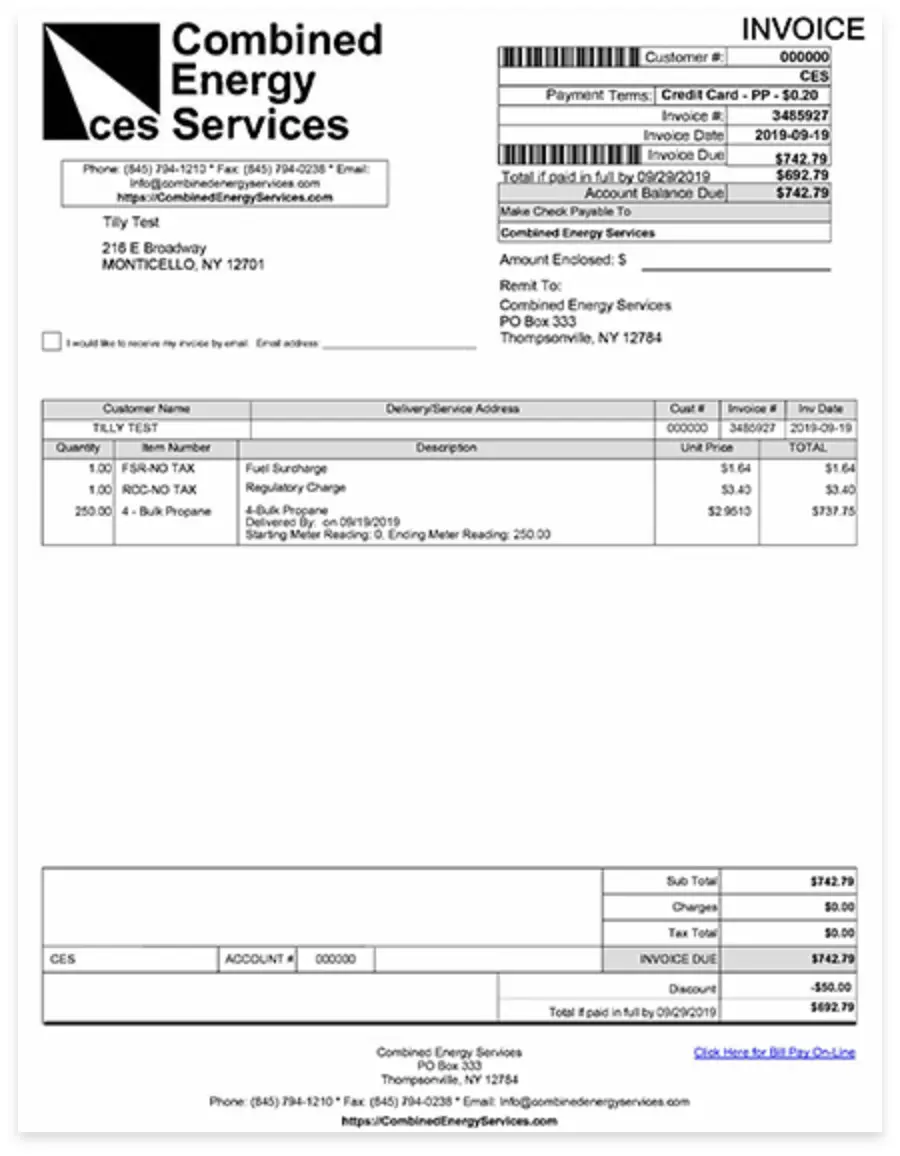

Understanding Your Bill

Information on pricing, discounts, & fees

There is a lot of information on your invoice from Combined Energy Services. We’d like to explain what it all means.

- Customer Number: This is your account number. Keep this number handy. It makes looking up your information easier.

- Payment Terms: Credit card, Cash on delivery (COD), Money in office, 10-day pay are just a few of the options.

- Invoice Due: This is the day that your statement is due without penalties or fees.

- Total if Paid in Full by: If eligible, this is a discount if you pay within 10 days.

- Account Balance Due: This is the total amount due on your account, including any past due amounts or fees. It may also include any service work that’s been completed.

- Fuel Surcharge: This fee is charged to cover fluctuating costs of fuel. In many companies, this fee varies as a percentage rate and is added to a shipper’s freight bill to cover the cost of operations.

- Regulatory Compliance Charge: RCC is also referred to as a hazmat fee. This fixed rate fee helps offset a portion of the costs incurred to comply with federal, state and local government regulations, including but not limited to, hazardous materials, homeland security, emergency preparedness and workplace safety.

- Gallons delivered, price per gallon, who made the delivery, the date of delivery and the start & ending meter reading. This information is used to calculate the amount due for your delivery.

- Message block: Information regarding your bill or delivery, can at times, appear in this area.

Important Parts of the Credit Application

Being as complete as possible on the credit application results in the quickest results. CES not only looks at your credit score but also your payment history in making our detemination to extend credit.

If you are not approved for an extension of credit, you still have several options for payment. You can keep a credit card on file or pay cash on delivery / advanced payment. We highly recommend our budget billing program. This program, which typically begins in May, spreads your heating bills over 12 months. Combine the budget program with automatic delivery, and you shouldn’t have to worry about your home heating fuel at all.

For more information on your bill, you can visit the common terms section.